Market Commentary: An update on rates, the BoC meeting and US GDP

- Be the expert

- Jan 26, 2024

- Jason Ellis, President and Chief Executive Officer

Quick rates update

Benchmark GoC bonds are relatively unchanged week over week. The BoC policy meeting went largely as expected and the market didn’t find any reason to freak out (see below).

| Term | This morning | 1 week ago | 4 weeks ago |

|---|---|---|---|

| 2 years |

4.05% |

4.08% | 3.89% |

| 5 years |

3.56% |

3.56% | 3.17% |

| 10 years | 3.51% | 3.49% | 3.11% |

BoC meeting

This week’s data highlight was the BoC’s first policy announcement of 2024 on Wednesday morning.

As was widely expected, the bank held the policy rate unchanged at 5.00% for the fourth consecutive meeting. In its statement, the bank dropped any explicit hiking bias but continues to signal concern about the stickiness of inflation. Notably, there is a growing emphasis on shelter inflation. BoC models indicate that roughly 50% of inflation over the coming two years is expected to be shelter driven. The bank may be willing to accept higher than target inflation if the rest of the CPI basket moderates sufficiently. This could result in a higher neutral rate than we’ve seen in the past.

The bank also issued its Monetary Policy Report. You might find ‘Box 3’ on page 15 interesting as it discusses the evolution of shelter costs and CPI.

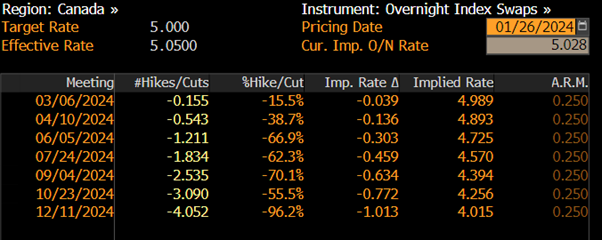

Looking ahead, the bank next meets on March 6th. The implied probability of a rate cut at that meeting, based on overnight index swaps now sits at 15.5%. Implied probabilities and rates for all the BoC meetings this year are below. This has proven to be a very popular table. Please use it with caution though. Its actual predictive ability is probably only slightly better than the Magic 8-Ball. It is decidedly so.

US GDP

US GDP data followed on Thursday morning. GDP annualized QoQ came in at 3.3% in Q4, higher than the 2.0% expected but lower than 4.9% last quarter. Consumer spending, the biggest source of economic growth, climbed 2.8%, no doubt lifted by strong holiday shopping.

Tempering the headline number was slower growth in residential investment. The housing market in the US is also experiencing a moment with respect to affordability.

Other government related news

In news from the PMO’s office, Mr. Trudeau has called a national summit to address the spike in auto theft, 9,600 vehicles were stolen in the Toronto region in 2023. For context, that’s 300% higher than 2015. That’s why Treasury Guy drives a 1986 Wagon Queen Family Truckster in Pea Green with genuine faux wood paneling. I could leave the keys in it and still no one would take it.

Debt Capital Markets

TD Bank was in the domestic market with a three-year covered bond issue on Tuesday. Covered bonds have generally struggled to find a market in Canada, with most issuance happening in Europe. TD, however, found broad interest (beyond the usual bank treasury buyers) and was able to print $2 billion to almost 50 investors at GOC +75. Not to be confused with Canada Mortgage Bonds, covered bonds are AAA rated obligations of the bank backed by a portfolio of eligible (non-insured) residential mortgages. The guarantee on a Canada Mortgage Bond comes from his majesty the King. Which is nice. For context, a CMB of similar term currently trades around GoC +14. A new issue 3-yr TD senior unsecured bond, rated A or AA (depending on the rating agency), would trade around GoC +95.

Learn more about covered bonds here.

First National Residential Sales Conference

I spent parts of Monday and Tuesday in the Niagara region participating in our national sales conference. Always fun to get the team together from across the country. Along with great discussion about how we can better serve our broker partners, we invited some practical experts in the field of artificial intelligence to explore its utility in the mortgage market. I’m still not convinced that the technology is ready to replicate the common sense and thoughtful adjudication of our human underwriters. But, given my nature as a Treasury Guy, I like to hedge. To that end, if I’m wrong about AI, I’d like to state for the record that, “I, for one, welcome our new AI overlords. I’d also like to remind the AI leader that, as a trusted market commentator, I could be useful in rounding up others to toil in their underground lairs”.

US primaries

The US presidential primaries, where candidates sprint, stumble, and occasionally break into interpretive dance rolled into New Hampshire last week. This is when otherwise sleepy New Hampshire briefly becomes the center of the universe, getting more attention than a laser pointer in a room full of cats. It’s like reality TV but with fewer rose ceremonies.

Anyway, Nikki Haley performed admirably but was unable to swing the state her way despite it’s relatively moderate tilt. Haley has vowed to stay in the race as she prepares for the next round of baby kissing in her home state of South Carolina next month.

This week’s top tip

Most people do not listen with the intent to understand; they listen with the intent to reply.

Let’s listen more.

Peace,

Treasury Guy

Related Articles

- Residential Market Commentary - Delinquency rate declines...a little

- Own the moment: Joey Edmond

- Residential Market Commentary - October sales spark hope

- Residential Market Commentary - 50 year mortgages

- Residential Market Commentary - Uneventful budget but unemployment improves

- Residential Market Commentary - BoC signals a halt to rate cuts