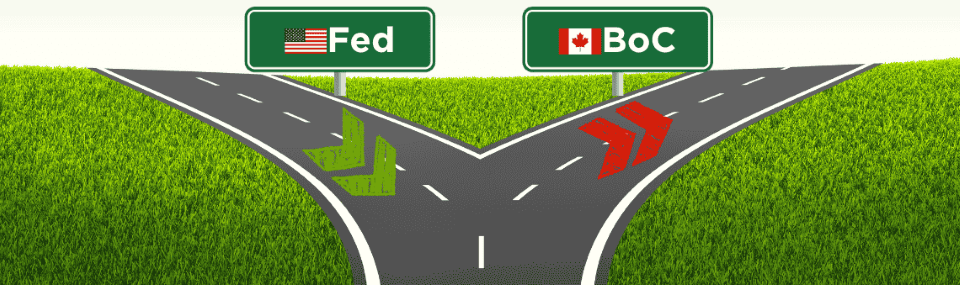

On the Radar: US Fed Turns Dovish While The Bank of Canada Stands Pat

- Capital Markets update

- Nov 28, 2025

- First National Financial LP

Three Takeaways

- In one week, U.S. December cut odds jumped from roughly 20 percent to near 80 percent as Fed speakers and the Beige Book turned more dovish.

- Canadian data barely moved, leaving the BoC comfortable holding at 2.25 percent with only token odds of a December cut.

- The key question for Canadian borrowers is not whether the BoC “follows” the Fed on December 10, but how much of the Fed’s renewed dovishness bleeds into GoC yields and mortgage rates over the coming months.

Last week, our prior “On The Radar” argued that rate-cut odds for December had “plummeted” on both sides of the border as central banks turned more cautious. At that point, futures implied roughly a one-in-three chance of a December cut from the Fed and about a one-in-eight chance from the BoC, down from about 70 percent and 23 percent, respectively, in early November.

What changed since then is not a surge in bad data but a clear shift in U.S. Fed communication. On Friday (shortly after we published "On the Radar"), Governor Williams told a conference in Chile that policy was only “modestly restrictive” and that he still saw room for a “further adjustment in the near term” to move the fed funds rate closer to neutral.

Then, on Monday this week, Governor Waller went further, saying the job market is weak enough to warrant another quarter-point cut in December, subject to incoming data. That pushed FedWatch probabilities up toward 80 percent, from about 23 percent earlier in November.

In effect, the same Fed that spent October and early November warning that a December cut was “far from assured” has now told markets that another move lower is not only possible but likely if the labor market continues to soften.

What is the Beige Book, and why does it suddenly matter?

The November Beige Book dropped into this communications vacuum on Wednesday this week and reinforced the dovish narrative. The Beige Book is the Fed’s qualitative survey of current economic conditions across its 12 districts, based on interviews and reports from businesses, community groups, and other contacts. It is published eight times per year and is designed to give policymakers a timely, anecdotal read that complements the hard data.

In this week's edition, the national summary said overall economic activity was “little changed” since the previous report. Still, it highlighted that consumer spending had declined and that employment had “declined slightly” with weaker labor demand in about half of the districts. Wages were described as growing at a modest pace, while price increases were moderate and still influenced by tariffs and higher insurance and health-care costs.

With the 43-day U.S. government shutdown delaying key data releases, this Beige Book will carry more weight than usual heading into the December meeting. With jobs and inflation data either stale or missing, qualitative evidence that firms are relying on hiring freezes, attrition, and shorter hours rather than layoffs adds to a picture of a gradually cooling labor market rather than an overheating one.

For Canadian readers, the Beige Book plays a role similar to the Bank of Canada’s Business Outlook Survey (BOS). The BOS is a quarterly survey of about 100 firms that asks detailed questions on sales, capacity, hiring, and inflation expectations; BoC staff roll this into indicators such as the BOS indicator, capacity pressures, and inflation expectations that feed directly into policy deliberations.

Where the BOS gives the Governing Council a structured quarterly snapshot, the Beige Book provides the FOMC with a narrative, district-by-district map of how businesses are experiencing the economy right before each meeting. In both cases, the message this quarter is similar: growth is not collapsing, but momentum is softer, and price pressures are no longer intensifying as they did in 2022–23.

Why is the Bank of Canada not following yet?

Canada’s data have not changed much since mid-November. October CPI printed at 2.2 percent year-on-year, down from 2.4 percent in September, with gasoline down 9.4 percent and grocery prices slowing to 3.4 percent. While the headline number has moved closer to target, the BoC’s preferred core measures (CPI-trim and CPI-median) are still hovering around 3 percent even after edging lower, and the average only dipped below 3 percent for the first time since June.

That is why, when the BoC cut its policy rate to 2.25 percent on October 29, Governor Macklem said policy was likely “about the right level” and hinted that the easing cycle was probably done unless the outlook changed materially.

As a result, the December 10 meeting was overwhelmingly a hold on Canadian rates, with only a token probability assigned to another 25 bp cut. That is a sharp contrast to the U.S., where U.S. rate futures imply about an 85 percent chance of a December cut.

Will the U.S. easing eventually pull Canada lower?

History suggests that a sustained Fed easing cycle will eventually matter for Canada, even if the BoC initially tries to chart its own course. Bank of Canada research has shown that foreign monetary policy announcements, especially from the U.S., have sizable effects on Canadian bond yields via risk premia and expectations. In contrast, BoC announcements have little effect on U.S. yields. The Bank itself has also cautioned that higher or lower U.S. yields can spill over into Canadian household borrowing costs.

For now, the divergence is rational. The Fed is facing a data vacuum after a long shutdown and is leaning on a qualitative survey that points to softer job growth and cautious consumers. That has emboldened dovish officials like Williams and Waller to argue that another quarter-point cut is warranted, and markets have followed their lead.

The BoC, by contrast, has just seen the last CPI print before its December meeting, and it still shows underlying inflation running closer to 3 percent than 2 percent, even as the headline moves in the right direction.

The key question for Canadian borrowers is not whether the BoC “follows” the Fed on December 10, but how much of the Fed’s renewed dovishness bleeds into GoC yields and mortgage rates over the coming months. If Fed officials continue to emphasize labor-market risks and the Beige Book narrative stays soft, a lower global rate structure will do some of the easing work in Canada even if the BoC moves more slowly on its policy rate.

Sign up for Market updates

Looking for advice and insights on commercial real estate? Sign up today for the Market Update email.

Related Articles

- On the Radar: December Rate Cut Odds Plummet as the U.S. Fed and BoC Turn More Cautious

- On the Radar: When U.S. Jobs Disappear, What Happens to Canadian Rates?

- The CMB Upsize and Open Door for Further Exciting Developments

- On The Radar: What Is Next For U.S. And Canada Overnight Rates?

- On The Radar: What The Third Quarter Business Outlook Survey And The September Inflation Report Are Saying

- On the Radar: Yields Falling While Waiting For The October 29 Rate Decision