Market Commentary: Rate and GDP update and US employment numbers

- Capital Markets update

- Feb 2, 2024

- First National Financial LP

Greetings!

I’m the Treasury Guy. So, that’s what you call me. You know, that or, uh, his Treasury-ness, or uh, El Treasurino, if you’re not into the whole brevity thing.

Anyway, look, man, I’ve got certain information, all right? Certain things have come to light. And…this could be, uh…a lot more, uh, complex. I mean, it’s not just, such a simple…uh, you know?

Rates

How have rates evolved since last week? Well, you know, a ‘lotta ins, a ‘lotta outs, a ‘lotta what-have-yous’.

5-year bond yields fell steadily by over 20 basis points from last Friday until 8:30 this morning when they surged back by 10bps to currently sit around 3.45%. Why this sudden reversal of fortune? I’ll tell you in one word: Non-Farm Payrolls.

Here’s a 1-year chart of the generic 5-year benchmark GoC bond for context:

Are you employed sir?

US employers added more workers than any other month this year and wages jumped, suggesting a reacceleration of the labour market that may delay any Federal Reserve rate cuts.

Surging Non-farm payrolls of 353,000 compared to 185,000 expected, combined with upward revisions to the prior two months, triggered a sell off in bonds sending rates higher. Average hourly earnings also exceeded forecasts posting a +0.6% month over month vs. +0.3% expected.

Speaking of the Fed…

Speaking of the Fed and rate reductions, the Fed contemplated that very matter earlier this week on Wednesday afternoon. The Fed was widely expected to stay on the sidelines for the fourth consecutive meeting and they did exactly that. More significantly, the forward guidance formally dropped its tightening bias.

After today’s job data, the probability of a rate cut by the Fed at their next meeting on March 20th has plummeted from about 50% last week to about 20% today based on the Fed Funds Futures market.

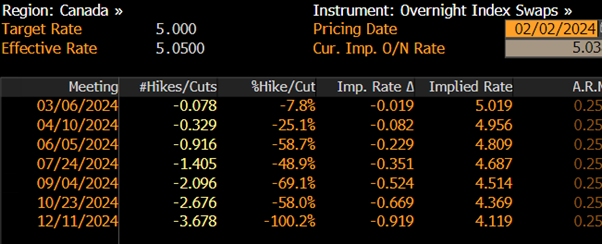

Back to the Great White North

We had some significant data here at home this week too.

On Wednesday, we learned that Canadian Real GDP (as opposed to Nominal GDP, not as opposed to pretend GDP) topped expectations with a 0.2% month over month increase in November. If December data delivers similarly, the economy will have grown at better than a 2.0% annualized pace in Q4. That won’t set any records, but it’s robust compared to recent quarters. This could lead some market observers/prognosticators to revise 2024 growth estimates higher which, in turn, could reduce pressure on the BoC to start cutting. We will anxiously await the next inflation print on February 20th. The next BoC rate decision follows on March 6th where the probability of a 25bp cut has shrunk to less than 10%.

This week’s Top Tip

It is a dangerous thing to confuse speaking without thought with speaking the truth.

But…that’s just like, uh, my opinion man.

The Treasury Guy abides.

Sign up for Market updates

Looking for advice and insights on commercial real estate? Sign up today for the Market Update email.

Related Articles

- On the Radar: When U.S. Jobs Disappear, What Happens to Canadian Rates?

- The CMB Upsize and Open Door for Further Exciting Developments

- On The Radar: What The Third Quarter Business Outlook Survey And The September Inflation Report Are Saying

- On the Radar: Yields Falling While Waiting For The October 29 Rate Decision

- On the Radar: Historic U.S. Government Shutdowns and Their Impact on Bond Yields (US & Canada)

- On the Radar: A Tale of Two Curves: Rising Odds of a September BoC Cut as Long Yields Climb