Yields are down on today’s US CPI data release. Headline US consumer prices for October were flat MoM and only increased 3.2% YoY. This was below expectations and down from 3.7% YoY in September. The next US Fed rate decision is December 13th which will likely have no change. The market sees a 30% chance of a cut by March 2024 and over 50% chance of a cut by May 2024.

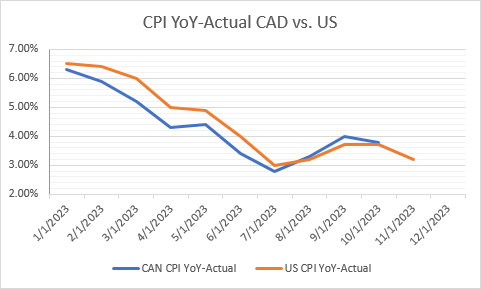

Below is the CAD vs. US CPI YoY comparison, inflation appears to have resumed its downward trend.

The next BOC meeting is December 6th with no rate change expected. Last week, we were pricing a cut but not until March 2024. The tone changed a little today and consensus is indicating an early rate cut could be as early as January with a 50% chance by April. Our eye is on our next CPI data to be published on November 21st. Will the hawkish tone continue or do we think the hiking cycle is over?

The November CMB is launched today, expected pricing tomorrow morning with a deal size of $7-8bn. This will be the largest CMB transaction on record. The 10 year CMB is around 4.16% down from 4.44% since the beginning of November. The 5yr CMB and 5yr GOC also down by 23bps and 20bps, respectively in that period.