Happy May two-four long weekend! This is the inaugural cottage weekend of the year so I will try and keep it brief as I know you’re all itching to start your long weekend! That, plus the fact that the markets close today at 1pm so our team gets a well-deserved (at least in my opinion) half day.

It’s been a rough week. Stocks are down for the seventh straight week, inflation is up again and for all you Tesla fans out there, the stock was kicked out of the S&P ESG Index due to concerns over staff working conditions. Somehow, Amazon is still a top holding though. I hate to pile on to the already difficult week, but this will be my final market commentary at First National.

I know many of my readers come for the intro and hopefully make it to the end but just in case I will start by saying that it has been quite the journey, and I am so grateful for my time at First National and for you, the reader, for following along on this adventure that is the market.

Now let’s get to it.

Newly issued CMB

Canada Housing Trust (“CHT”) issued its regular quarterly 10-year Canada Mortgage Bond (“CMB”) on Wednesday May 18th. The newly issued bond has a maturity date of September 2032 and was issued at a yield of 3.55% representing a spread of 53.5 basis points above the Canadian 10-year benchmark bond (maturing December 2031).

The deal size was on the higher end of what was expected totaling $3.75 billion. On a day where overall investor sentiment was risk off (if you haven’t checked your investments yet this week, make sure you do it after the long weekend) spreads moved out a few basis points and the bond is now trading at 55 basis points over the Canadian 10-year benchmark bond maturing December 2031. See the chart below for additional colour on the 10-year spread.

The next 10-year issuance is expected to be a re-opening of the newly issued September 2032 bond and will take place in August.

Since we are on the subject, the next 5-year CMB is quickly approaching with a pool date cutoff of June 1, and a maturity date on the bond of June 2027 with pricing to occur in mid-June.

Rates – putting it into perspective

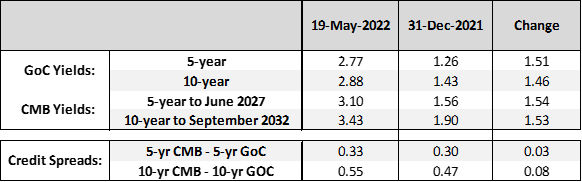

139 days have passed so far this year – in that time, yields on both the 5 and 10-year GoC and CMB have increased over 1 basis point per day! I can’t say that the 1bp/day trend will continue but there is still some room to go, and a 3.00% 10-year should not be ruled out.

Understandably, the CMB and GoC bond markets have probably taken up most of your time and attention over the last few months, but I think it’s worthwhile to provide you with some context on the residential side as well. Especially considering that a changing residential mortgage landscape can alter the multi-family side as well.

On residential mortgage rates, we started off the year with a conventional mortgage at 2.94% and are now at 4.84%. That is an increase of almost 200 basis points in less than 5 months! If you had a mortgage totaling $1million with a regular amortization period of 25 years, monthly payments would have gone from 4,702 to 5,726 in a matter of months!

Bottom line: does a payment change of over $1,000 a month on a $1mm mortgage or $500 a month on a $500k mortgage get people thinking about renting instead? The answer is yes. This is especially true when mortgage rates move up faster than housing prices move down.

Inflation – soft landing is the new transitory

Canadian CPI statistics were released on Wednesday and it is clear that inflation is still running hot. Annual inflation rose to 6.8% last month, up from 6.7% in February. These are the highest levels seen since January 1991. For those of you who were on the fence about going keto or gluten free, pasta prices are up 19.6% so now may be the time.

Bank of Canada (“BoC”) announcement – is 50 the new 25?

The Bank of Canada is expected to make their next interest rate decision on June 1st so keep your eyes peeled. As always, First National will bring you all the necessary details on the announcement so you can stay up to date. It is widely expected that the bank moves 50 basis points with another potential 50 basis point increase at their next meeting which is scheduled for July 13th.

Bottom line: there is a lot of chatter about central bankers willing to continue hiking rates to quell inflation, but the question remains, in this era, can central bankers really stomach a recession? Or more importantly, can a government stomach it enough to not get involved in the day-to-day dealings of central banks?

Lastly, it wouldn’t be election time without some cynical commentary from yours truly. Every pamphlet that I get on my door tells me how that party will block all the developments going up in my area and then on the next line, tell me that they will solve the affordability crisis. Now I am no Benjamin Tal, but I am pretty sure that’s not the solution.

We have officially reached the end of my final commentary – it has been a pleasure.

Until we meet again,

Neil