Market Commentary: An overview of this week’s federal budget

- Capital Markets update

- Apr 19, 2024

- First National Financial LP

This edition of the Treasury Guy is dedicated to all the people at the CMBA-BC conference who took the time to provide their very generous feedback. Thanks for the love, this one’s for you.

As it turns out, it’s a good week to write, as there is veritable cornucopia of news to report on. We’ve had fresh housing market data, Canadian CPI and a Federal Budget rich in mortgage related nuggets.

In fact, it’s such a bountiful harvest of material that even Treasury Guy’s cat could write this. Alas, I don’t have a cat, so I guess I’ll do it myself. For the record, if I did have a pet, it would probably be a Liger. It’s pretty much my favourite animal. It’s like a lion and a tiger mixed, bred for its skills in magic.

Connecting the dots on rates...

First things first, we should establish a base line from which we can draw some context. The last time I posted was January 26th. Back then, the 5-yr GoC bond was yielding 3.56% and the market was expecting at least four rate cuts totalling 100 bps from the BoC before the end of 2024.

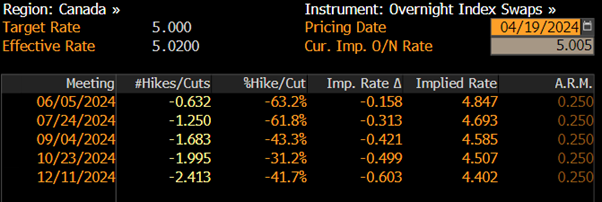

As of this morning, the 5yr bond is yielding 3.76% (+20 bps) and the implied probability for BoC rate cuts are down to just 2.4 rate cuts by the end of the year.

As an indicator of how competitive the residential mortgage market is, 5-year fixed rates are actually LOWER today than they were on January 26th, despite the fact that reference rates like the GoC bonds are 20 bps HIGHER.

CPI

Speaking of BoC expectations, the critical variable guiding the bank’s hand is inflation. Tuesday’s CPI for March was marginally below consensus at 2.9% year-over-year. The banks’ preferred measures of Trim and Median CPI printed around 0.1% m/m. This was the third straight report with a softening in core measures.

Notably, mortgage interest costs increased 25% year-over-year and remain the biggest driver of inflation. Rent prices jumped 8.5%. This component of inflation can have a multiplier effect on consumer spending that can further affect economic growth. Treasury Guy is calling for the first rate cut in June, but don’t quote me. I’m pretty good with economic forecasting, the way I’m pretty good with a Bo Staff. Not very.

No doubt the BoC will not give my prediction much consideration at its June 5th policy meeting, but it will apply significant weight to the next CPI update on May 21st. As you can see in the table above, the overnight index swap market is currently putting a 65% probability of a cut at that meeting.

The Budget

The federal budget included material spending increases for housing, defense and indigenous programs mostly offset by a higher capital gains tax. Too bad for all those suckers that bought NVIDIA stock last year. Now their massive capital gains will now attract 67% of their marginal tax rate (vs. 50%)! Overall, the deficit for fiscal year 24/25 was little changed and the 5-year profile was $10 billion higher than projected in the fall economic statement.

Some housing specific items include:

Rule changes:

- Increase apartment CCA from 4% to 10% on eligible new purpose-built rental projects beginning construction between April 2024 and January 2031.

- Launch of Secondary Suite Loan Program enabling homeowners access up to $40,000 in low-interest loans to add a secondary suite to their homes.

- Incentives to Encourage Densification (converting houses to triplex, secondary suite, etc.) by creating new opportunities for homeowners with, amongst other things, an increase in the applicable insured mortgage limit.

- Extension of First-Time Buyers Mortgage Amortization to 30yr (from 25yr) starting August 1, 2024.

- Increase RRSP HBP limit to $60,000 (from $35,000) effective April 16, 2024.

- Extension of the Grace Period to Repay RRSP Withdrawals by an additional three years for withdrawals between January 2022 and December 2025.

- Extension of the Foreign Homebuyers Ban until January 2027.

Funding:

- Additional $15B for the Apartment Construction Loan Program which provides low-cost repayable loans to builders and developers.

- Additional $1B to the Affordable Housing Fund which provides low-interest or forgivable loans for affordable housing.

- Additional $400mm to the Housing Accelerator Fund (currently $4B) to incentivize zoning removal and speed up permitting.

- Launch of a $6B new Canada Housing Infrastructure Fund to accelerate the construction and upgrading of critical housing infrastructure.

- Launch of a $1.5B new Canada Rental Protection Fund to acquire affordable rental units at risk of being sold to investors.

Others:

- The creation of a New Canadian Renters’ Bill of Rights

- The launch of the Canada Builds initiative

- The launch of Public Lands for Homes plans

Find the full Canada Housing Plan here.

Housing Market

Home sales edged up 0.5% in March compared to February for a third month over month increase in the last four months. Active listings also edged up by 0.5%, leaving the listings to sales ratio unchanged at 3.8. On a year over year basis, home sales were up 1.7%.

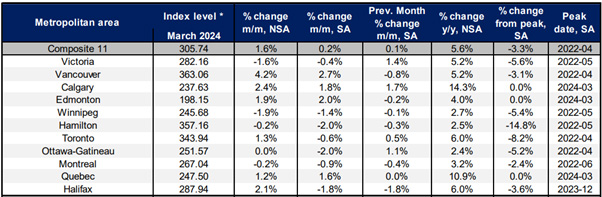

The Teranet-National Bank composite House Price Index rose by 0.2% (seasonally adjusted) led by Vancouver (+2.7%) and moderated by Montreal (-0.9%) and Toronto (-0.6%). The composite index is now down 3.3% from peak set in April of 2022. The table below shows HPI stats for various metropolitan areas. Note how the change from peak prices is different across regions.

According to Statistics Canada, Canadian Mortgage credit was up 3.4% year-over-year in February, little changed from the prior month. This is a notable slow down from the double-digit growth rates seen during the low-rate period of the pandemic. Still, even this more modest growth in credit is evidence of a stable housing market.here

Looking ahead, strong demographic growth, low vacancy rates and a central bank poised to cut rates should provide a constructive foundation (no pun intended) for housing activity in the coming months.

Gold-because no one asked...

Police arrested six people this week in a multijurisdictional investigation into the theft of $20 million in gold bars at Toronto Pearson Airport. Warrants have been issued for others, including Air Canada employees. Unfortunately, the culprits did NOT use modified Mini’s to make a get away through TTC subway tunnels.

In the meantime, the spot price of gold is reaching new all-time heights, trading at $2,375. Good news for gold holders...except for the new capital gains tax.

This weeks Top Tip

It’s impossible for a person to learn what they think they already know.

Well, that’s it. It’s the weekend. What are you doing? I’ll probably continue with my training to be a cage fighter or go wolverine hunting in Alaska.

Cheers,

Treasury Guy

Sign up for Market updates

Looking for advice and insights on commercial real estate? Sign up today for the Market Update email.

Related Articles

- On the Radar: December Rate Cut Odds Plummet as the U.S. Fed and BoC Turn More Cautious

- The CMB Upsize and Open Door for Further Exciting Developments

- On the Radar: Why a September 17 Bank of Canada Rate Cut Looks “Almost Certain”

- On the Radar: Has Canada’s Job Market Stabilized After Tariff Turbulence, and What Does It Mean for Rates

- On the Radar: US GDP Beats Forecasts and Canada and the U.S. Hold Rates: What does this mean for future interest rates?

- Bank of Canada keeps interest rate policy unchanged at July 2025 meeting