Market Commentary: A post-mortem of this month’s bond sell-off

- Capital Markets update

- Oct 1, 2021

- Neil Silverberg, Senior Analyst, Capital Markets

With Thanksgiving quickly approaching, I am thankful for new seasons of Curb Your Enthusiasm and Succession coming this month. Not to mention the fact that Seinfeld is finally on Netflix starting today, so if you have any questions about the Penske file, feel free to reach out!

A post-mortem of this month’s bond sell-off

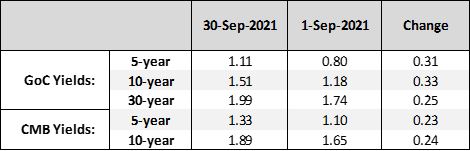

Now that we are into October, it is worth revisiting some of the price action that we saw throughout the month of September. In short, it appears as if the correction lower in yields is over and we should start thinking about yields potentially moving back up…. Could we see a 1.75% 10-year yield by the end of the year? I know better than to make predictions but it’s definitely not out of the question. Before I get into the reasons for the sell-off, here is a chart with a more detailed breakdown of the shift in yields in the treasury curve and credit curve over the last month:

For those who aren’t aware, a bond sell-off could be viewed as optimistic for future growth. With COVID cases on the decline in the U.S., additional U.S. infrastructure spending and a large amount of U.S. and Canadian bond supply coming down the pipe, all signs point towards yields continuing to move higher.

In addition to this, at last week’s Federal Open Market Committee (FOMC) meeting, the Federal Reserve reiterated that they are expecting to begin tapering their asset purchases in November or December of this year and policy rate increases are still expected to occur in the 2nd half of 2022.

On the flip side, although the Fed’s latest announcement has been viewed in the market as hawkish, the federal funds rate (target interest rate set by the FOMC) still sits at 1.75% while inflation is expected to be between 2.0% – 2.5%. This means that the real fed funds rate is still going to be negative, which is extremely accommodative central bank policy.

Transitory or non-transitory? That is the question

The narrative surrounding inflation is of course whether it will persist or simply be transitory. Rolling supply shocks and constraints are expected to persist. However, as we head towards the colder months, we are already starting to see flatter restaurant and retail spending, which is typically seen as deflationary as the economy drifts away from the normalization that had begun this summer.

What does this all mean for you?

Yields, inflation, and central bank policy have all been dominating restaurant chatter and newspaper headlines over the last few months and it doesn’t seem to be slowing down anytime soon (okay, maybe it’s only restaurant chatter at the tables where I sit). Whether you plan on locking in your mortgage within the next few weeks or you are looking at purchasing that new apartment building, you should be keeping a close eye on the rates market. Watching closely can ensure that you can accurately model your investment returns, including any interest rate contingencies required, and make the best possible decisions on any potential acquisitions or refinances that are coming down the pipe.

With the volatility and uncertainty in the market, First National is always happy to lend a helping hand through our knowledgeable team of advisors and our early rate lock program to help navigate this rocky terrain.

Thanks for reading and have a good weekend,

Neil

Sign up for Market updates

Looking for advice and insights on commercial real estate? Sign up today for the Market Update email.

Related Articles

- On the Radar: December Rate Cut Odds Plummet as the U.S. Fed and BoC Turn More Cautious

- On the Radar: When U.S. Jobs Disappear, What Happens to Canadian Rates?

- The CMB Upsize and Open Door for Further Exciting Developments

- On The Radar: What Is Next For U.S. And Canada Overnight Rates?

- On The Radar: What The Third Quarter Business Outlook Survey And The September Inflation Report Are Saying

- On the Radar: Yields Falling While Waiting For The October 29 Rate Decision